Introduction

Sherlock's is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the Franfinance 3xWEB and 4xWEB means of payment integration integration into Sherlock's.

Who does this document target?

This document is intended to help you implement the Franfinance 3xWEB and 4xWEB means of payment integration on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Sherlock's solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding Franfinance 3xWEB and 4xWEB payments with Sherlock's

General principles

Specialised in consumer credit, the French company Franfinance 3xWEB and 4xWEB is a solution reserved for private persons of legal age holding a credit card valid for at least 3 months after the contract signing date for payment in instalments and the use of which is not subject to a systematic authorisation request (especially Visa Electron and Maestro cards).

With this solution, customers pay for their online purchases in 3 or 4 installments.

During a Franfinance 3xWEB and 4xWEB payment, customers complete their personal data as well as credit card details.

At the end of the entry, they are informed online of the request result.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | V | Default payment channel |

| End-of-day payment | X | |

| Deferred payment | X | |

| Payment upon shipping | X | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EUR only |

| Currency settlement | X | EUR only |

Payment pages

The pages for this means of payment are managed and hosted by Franfinance.

A first page allows the customer to complete the data necessary for his 3xWEB and 4xWEB subscription.

Following the validation of the latter, the customer will be offered to enter his card information in order to initiate the payment:

- his card number

- his card expiry date

- his card security code

If any of these data are missing or invalid, or if the card number entered is not in range, an error message is displayed and a new entry is requested.

The Sherlock's standard operation applies: the entry attempts number is limited; an error code is returned if the number of attempts is exceeded:

Following the payment completion, a ticket page showing the transaction result is displayed to the customer. This ticket has a "return shop" button allowing to navigate back to your website with the Franfinance 3xWEB and 4xWEB payment response.

The Sherlock’s Paypage standard options apply: this ticket can be deactivated at your request. If you place the bypassReceiptPage ticket option, the ticket is not displayed. The customer is redirected straight to your website.

Depending on the authorisation request result, different messages will be displayed on the ticket for customers.

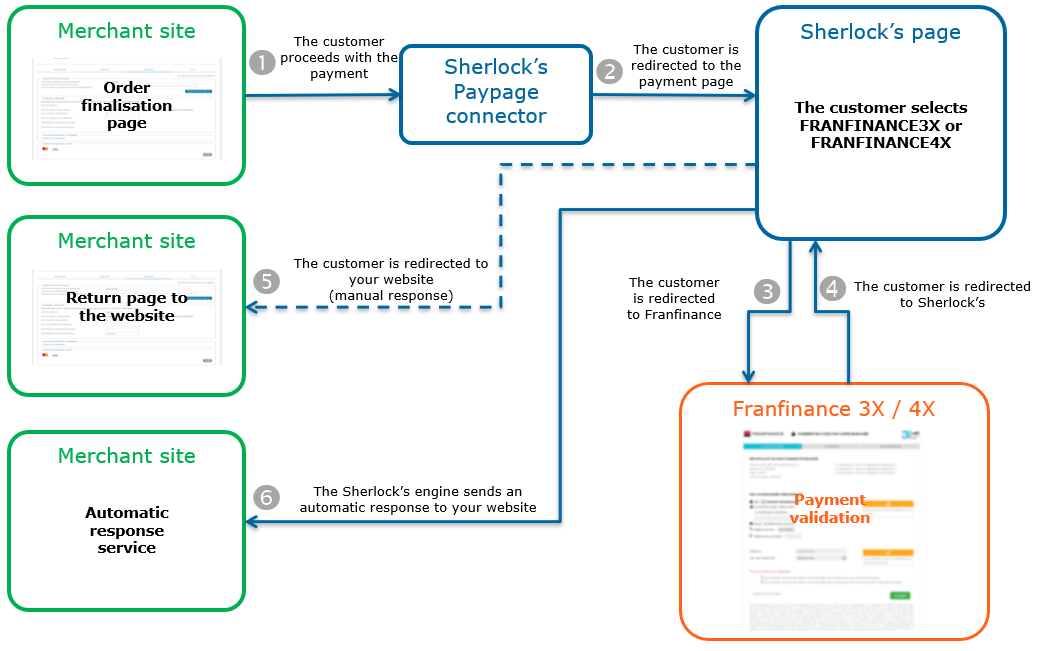

If the customer does not return to your merchant website (case of a disruption in the payment process), an automatic response will be sent to you with the transaction result up to 24 hours after the payment began. Generally, the delay is between 30 minutes and 1 hour.

Signing your Franfinance 3xWEB and 4xWEB acceptance contract

In order to offer the Franfinance 3xWEB and 4xWEB means of payment on your website, you have to sign an acceptance contract with Franfinance. Thereafter, you transmit us the contract number for recording in our information system.

Making a Franfinance 3xWEB and 4xWEB payment

You can offer the Franfinance 3xWEB and 4xWEB means of payment through the Sherlock’s Paypage which directly acts as the payment interface with customers via their web browser.

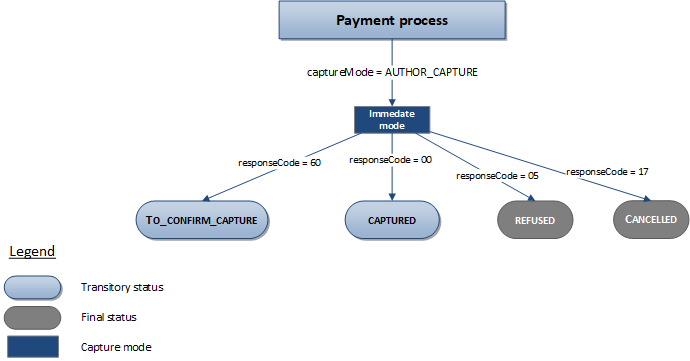

The only remittance mode available for a Franfinance transaction is the immediate mode (the transaction remittance is executed at the time of the online payment acceptance).

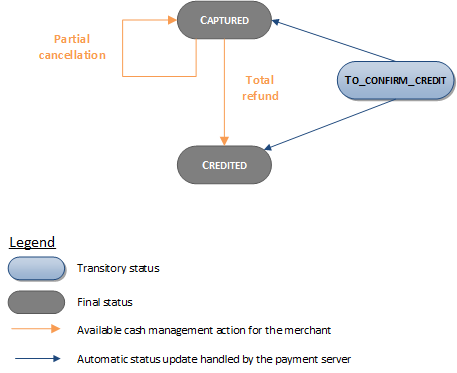

The diagram below explains the different transaction statuses according to the chosen capture mode:

Making a Franfinance 3xWEB and 4xWEB payment with Sherlock’s Paypage

The payment process for Sherlock’s Paypage is described below:

Setting the payment request

The existing paymentMeanBrandList field must be populated with the means of payment list offered to the customer and specifically the Franfinance means of payment.

Specific information is required for a Franfinance 3xWEB and 4xWEB payment request:

| Field name | Remarks/rules |

|---|---|

| amount | Amount in cents |

| captureMode | Tհe value sent in the request is ignored. The capture

mode is forced to IMMEDIATE. |

| currencyCode | Mandatory: EUR only (978) |

| customerId | Optional. Customer identifier. |

| orderId | Mandatory. Order number. |

| customerIpAddress | Optional. Customer IP address. |

| bypassReceiptPage | Optional. Indicates that you want to bypass the ticket

type pages. |

customerAccountHistoric

| Field name | Remarks/rules |

|---|---|

| customerAccountHistoric.creationDate | Optional. Creation date. With the

customerAccount container, the customer account creation

date on your website is used to calculate the date of the

account. |

customerAddress

| Field name | Remarks/rules |

|---|---|

| customerAddress.streetNumber | Optional. Customer street number. |

| customerAddress.street | Mandatory |

| customerAddress.addressAdditional1 | Optional |

| customerAddress.zipCode | Mandatory |

| customerAddress.city | Mandatory |

| customerAddress.country | Mandatory. Address country code. |

customerContact

| Field name | Remarks/rules |

|---|---|

| customerContact.email | Mandatory |

| customerContact.lastName | Mandatory |

| customerContact.maidenName | Optional |

| customerContact.firstName | Mandatory |

| customerContact.mobile | Mandatory |

| customerContact.title | Optional. Contact title. |

| customerContact.legalId | Optional. Establishment national identifier (SIRET for

France). This data applies to you and to the customer

(see Contact fields). |

| customerContact.positionOccupied | Optional. Occupied position. |

billingAddress

| Field name | Remarks/rules |

|---|---|

| billingAddress.streetNumber | Optional. Address street number. |

| billingAddress.street | Mandatory. Address street name. |

| billingAddress.zipCode | Mandatory. Address zip code. |

| billingAddress.city | Mandatory. Address city. |

| billingAddress.country | Mandatory. Contact country |

billingContact

| Field name | Remarks/rules |

|---|---|

| billingContact.email | Optional. Contact email. |

| billingContact.mobile | Optional. Contact mobile phone number. |

| billingContact.title | Optional. Contact title. |

| billingContact.lastname | Optional. Contact last name. |

| billingContact.firstname | Optional. Contact first name. |

| billingContact.company | Optional. Contact company. |

deliveryAddress

| Field name | Remarks/rules |

|---|---|

| deliveryAddress.streetNumber | Optional. Address street number. |

| deliveryAddress.street | Mandatory. Address street name. |

| deliveryAddress.zipCode | Mandatory. Address zip code. |

| deliveryAddress.city | Mandatory. Address city. |

| deliveryAddress.country | Optional. Address country. |

deliveryContact

| Field name | Remarks/rules |

|---|---|

| deliveryContact.email | Optional. Contact email. |

| deliveryContact.mobile | Optional. Contact mobile phone number. |

| deliveryContact.title | Optional. Contact title. M for mister, Mme

for madam |

| deliveryContact.lastname | Optional. Contact last name. |

| deliveryContact.firstname | Optional. Contact first name. |

| deliveryContact.businessName | Optional. Business name. |

| deliveryContact.company | Optional. Contact company. |

| deliveryContact.positionOccupied | Optional. Occupied position. |

deliveryData

| Field name | Remarks/rules |

|---|---|

| deliveryData.deliveryMethod | Optional. The chosen delivery method (standard,

priority, ...). |

| deliveryData.deliveryOperator | Optional. Name of the operator making the

delivery. |

| deliveryData.electronicDeliveryIndicator | Optional. Indicates whether the delivery is in an

electronic mode. |

| deliveryData.estimatedDeliveryDelay | Optional. Your estimated delivery delay (in number of

days). |

paymentMeanData

| Field name | Remarks/rules |

|---|---|

| paymentMeanData.franfinance3xcb.authenticationKey | Mandatory. Channel provided by Franfinance. |

| paymentMeanData.franfinance4xcb.authenticationKey | Mandatory. Channel provided by Franfinance. |

shoppingCartDetail

| Field name | Remarks/rules |

|---|---|

| shoppingCartDetail.mainProduct | Mandatory. Most expensive product in the

basket. |

| shoppingCartDetail.shoppingCartTotalQuantity | Mandatory. Total quantity of all products in the

basket |

| shoppingCartDetail.shoppingCartItemList.itemX.productCategory | Optional. Category of the ordered

product. |

| shoppingCartDetail.shoppingCartItemList.itemX.productDescription | Mandatory. Detailed description of the ordered

product. Catégorie du produit

commandé. Example : 1 1 : Food and Gastronomy 2 : Auto and Moto 3 : Culture and Entertainment 4 : Home and Garden 5 : Home appliance 6 : Auctions and Group Purchases 7 : Flowers and Gifts 8 : Computers and Software 9 : Health and beauty 10 : Particular services 11 : Services for professionals 12 : Sport 13 : Clothes and Accessories 14 : Travel and Tourism 15 : Hifi, Photo and Videos 16 : Telephony and Communication 17 : Jewelry and Precious Metals 18 : Baby items and accessories 19 : Sound and Light |

| shoppingCartDetail.shoppingCartItemList.itemX.productName | Mandatory. Name of the ordered product. |

| shoppingCartDetail.shoppingCartItemList.itemX.productQuantity | Mandatory. Quantity of products in the

basket. |

| shoppingCartDetail.shoppingCartItemList.itemX.productUnitAmount | Optional. Unit amount of the product. The

amount must be transferred in the smallest currency

unit. |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).paymentMeanBrand =

FRANFINANCE_3X or FRANFINANCE_4XpaymentMeanType =

ONLINE_CREDITresponseCode =

00 |

You can deliver the order. |

| Pending transation | acquirerResponseCode =

60responseCode =

60 |

We are waiting for the authorization confirmation. From

there, the confirmation batch will automatically update the

transaction as soon as a final response is obtained. |

| Customer cancellation | responseCode = 17 |

N/A |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90, 99

|

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making a Franfinance 3xWEB and 4xWEB payment with Sherlock’s Office

The Franfinance 3xWEB and 4xWEB means of payment acceptance is not available through the Sherlock’s Office solution.

Managing your Franfinance 3xWEB and 4xWEB transactions

Available cash operations

The following operations are available on Franfinance 3xWEB and 4xWEB transactions:

| Cash management | ||

|---|---|---|

| Cancellation | X | |

| Validation | X | |

| Refund | V | |

| Duplication | X | |

| Credit | X | |

The diagram below informs you which cash management operation is available when a transaction is in a given state:

Testing Franfinance 3xWEB et 4xWEB

To test Franfinance 3xWEB and 4xWEB, send a request to the url corresponding to your connector:

- Sherlock’s Paypage POST : https://payment-webinit-sherlocks.test.sips-services.com/paymentInit

- Sherlock’s Paypage SOAP : https://payment-webinit-sherlocks.test.sips-services.com/services/v2/paymentInit

- Sherlock’s Paypage JSON : https://payment-webinit-sherlocks.test.sips-services.com/rs-services/v2/paymentInit

Viewing your Franfinance 3xWEB and 4xWEB transactions

Reports

The reports provided by Sherlock's allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Franfinance 3xWEB and 4xWEB transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | V |

| Chargebacks report | X |

Franfinance 3xWEB and 4xWEB reconciliations

The principle

This is to provide a daily report reconciling:

Transactions sent by FRANFINANCE (debit and/or credit remittance), on the one hand, and transactions made on SIPS, on the other hand.

Each file contains, among other things, the transactions credited or debited to your accounts. Each file is global for all merchants.

Sherlock's receives these files and reconcile them with the remitted transactions (debits and credits).

From this reconciliation, Sherlock's sends you a "Reconciliations report". Sending the Reconciliations report is not synchronised with the FRANFINANCE files processing.

This type of report allows to have a genuine information as to the actual payment remittance or the FRANFINANCE financing.

Reconciliations statuses

In order to define the reconciliation status, two delays (after Sherlock's remittance date) are defined:

- a 30-days delay is the normal length on which a transaction must be reconciled.

- a 40-days delay is the maximum post-transaction date period date during which a transaction can be reconciled. Beyond this period, the transaction is no longer "reconcilable".

The delay between 30 and 40 days corresponds to the time interval on which Franfinance will have to analyse the cause of the non-reconciliation. When the 40 days are up, the transaction will be considered as not reconciled.

After analysing the reconciliation criteria defined above, the different possible reconciliation statuses are as follows:

| Transaction status | Merchant decision / Franfinance information | |

|---|---|---|

| File presence | MATCH_OK MATCH_INFO (statuses indicates a delivery info) | |

| File absence | 30 days MATCH_WARNING ≤ 40 days (**) 40 days< MATCH_ERROR (**) |

Transactions reconciliation

Details pertaining to transactions accepted during contract review are compared with transactions processed by Sherlock's.

Details of an operation that corresponds to a transaction are kept and reported in the Reconciliations report that is sent to the customer.

The reconciliation status for this transaction becomes MATCH_OK.

If Franfinance mentions a particular warning for this transaction, the status, certainly "matched" technically, becomes MATCH_INFO.

For this type of status, the SPECIFIC_DATA column of the Reconciliations report makes it possible to know the reason for the warning.

| Franfinance code provided in RGI and returned to the merchant in the SPECIFIC_DATA column | Technical status conveyed in the Reconciliations report |

|---|---|

| 00 - Financing guaranteed - Delivery | MATCH_OK |

| 00 – Refund considered | MATCH_OK |

| 02 - Financing refused - Do not deliver | MATCH_INFO |

| 03 – Transaction cancellation – Do not deliver | MATCH_INFO |

| XX - Other free wordings (not starting with 00) | MATCH_INFO |

| YY - Other free wordings (not starting with 00) | MATCH_INFO |

Unreconciled transactions

The remitted and not credited transactions to the merchant's account are subject to analysis.

The transactions reconciliation status that have a payment date more than 30 days and whose status is still MATCH_WAIT will become MATCH_WARNING.

Similarly, the transactions status with a MATCH_WARNING status and with a payment date more than 40 days will become MATCH_ERROR.

A report of the reconciliation anomalies is then generated for analysis.

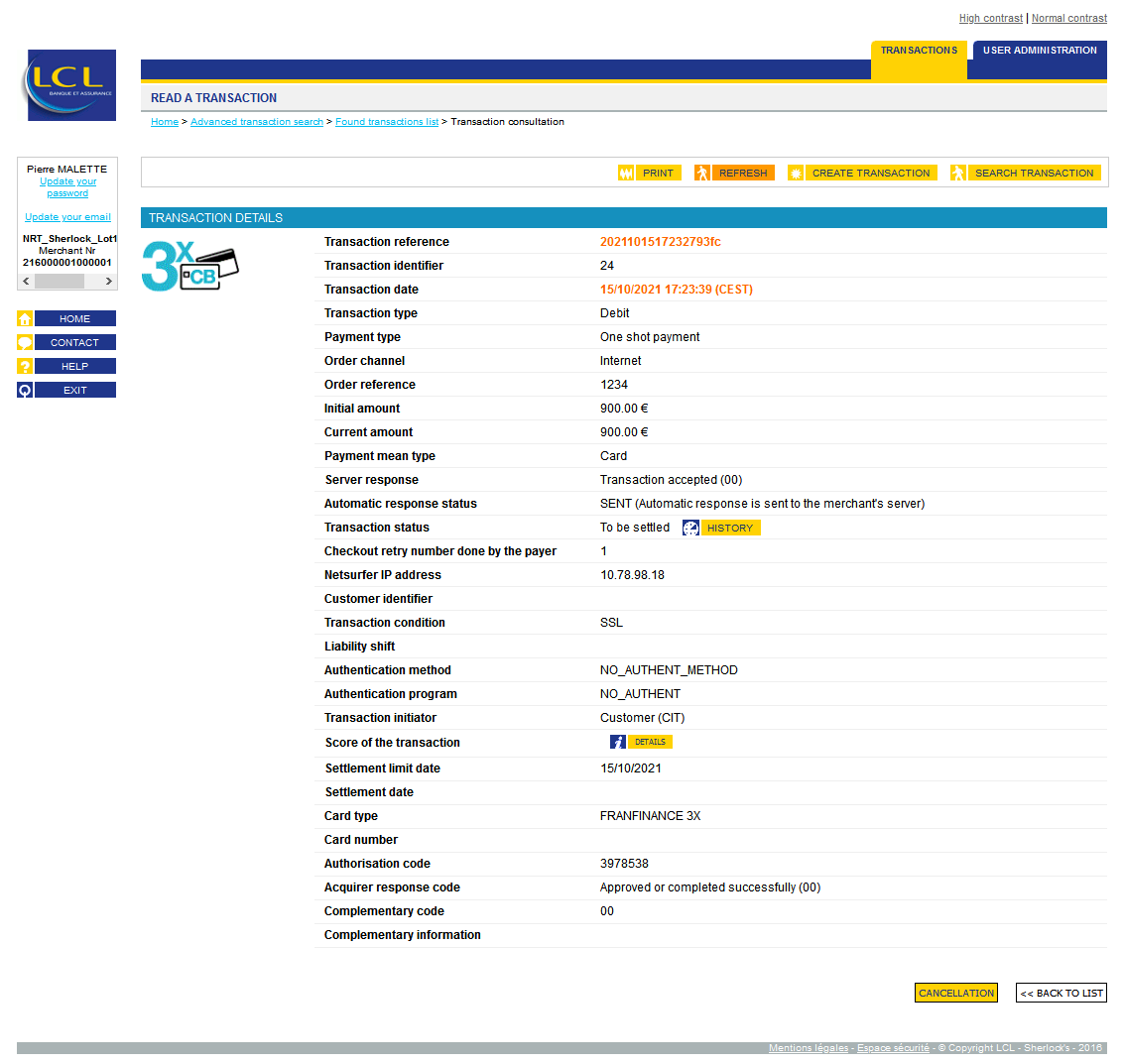

Sherlock's Gestion

You can view your Franfinance 3xWEB and 4xWEB transactions and perform various cash management operations with Sherlock's Gestion.